The Power of Automated Underwriting in Insurance

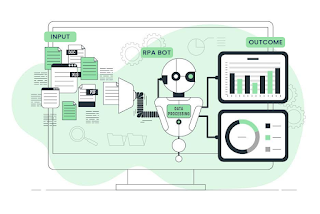

A study by Accenture reveals that 80% of insurance executives believe that automation, AI, and ML-based analytics can drive high value for their businesses. Underwriting is considered one of the largest use case segments for insurance automation. Reliance on historical data and the laborious process of aggregating it makes underwriting the ideal candidate for insurance automation tools. Carriers who rely on automated underwriting in insurance report more efficiency, accuracy, scalability, and consumer satisfaction than competitors who still use traditional insurance processes. In this blog, we delve into the intricacies of automated underwriting, exploring its benefits, challenges, and the future it holds for the insurance industry. Why does Automated Underwriting in Insurance matter? Manually coordinating data acquisition, managing multiple spreadsheets, and entering and re-entering data across many different systems can overwhelm already stretched underwriters. L...