Unlocking the Future - Modernizing Legacy Insurance Core Systems

As per Verified Market Research, the world’s insurtech market was valued at about $9.15 billion in 2020 and is expected to surge to $16.36 billion by 2028. This remarkable growth indicates rapid evolution and widespread adoption of digital solutions across the industry, placing immense pressure on insurers to stay competitive.

So, what issues plague the current insurance systems?

Legacy insurance core systems demand substantial maintenance and costs, taking all the necessary time and effort that could otherwise be allocated to improve performance.

As a result:

These outdated systems impede insurers' operational efficiency, resulting in potential revenue losses.

They prove cumbersome for users, often failing to provide real-time information to customers.

Overhauling the existing system can be technically challenging, but the resulting advantages far outweigh the effort.

Overhaul your Insurance Core System

Outdated insurance systems frequently run on local servers, significantly restricting software capabilities. Insurance software can be renewed with the help of two primary methods:

Construct a custom solution from scratch.

Modernize an existing legacy platform, migrate it to a cloud-based environment, and equip it with new features and integrations.

Here's a step-by-step guide:

Do a detailed analysis to list down requirements and set off the discovery phase.

Establish clear expectations for the development life cycle.

Find a reliable custom software development provider with relevant expertise.

Implement necessary integrations, instill cybersecurity measures and thoroughly test the software built.

Maintain ongoing communication with the provider throughout development.

Budget for all underlying expenses.

Choosing the Right Path

Selecting the most suitable approach to improve a core system necessitates a thorough understanding of an insurance company's business objectives. The following factors should be considered:

Functionalities and effectiveness of the current system

Business goals the insurance company aims to achieve

The allocated budget for the software enhancement

Benefits of Modernizing Insurance Core Systems

Upgrading your system on time offers benefits beyond numbers and statistics, enhancing client satisfaction and streamlining business operations.

Enhanced customer experience

Responsive UI – Provide intuitive user interfaces to make it easy for clients to find necessary offers.

Quick support – Imparts updated core systems to enable swift responses to customer inquiries, simplifying processes like policy registration.

High scalability – Offers systems that can efficiently handle increased traffic loads, accommodating the needs of numerous clients simultaneously.

Improved operational efficiency

Business intelligence solutions – Helps insurers view crucial stats via detailed dashboards.

Workflow efficiency – Allows efficient collaboration with secure multi-level access.

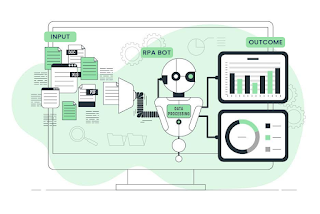

Automated processes - Eliminates productivity bottlenecks associated with routine tasks like underwriting and claims processing.

Reduced IT costs

Easy customization – Offers easily configurable software that is less susceptible to errors and complex optimizations that can disrupt business operations.

Real-time digital functionalities – Helps to service a number of clients simultaneously with a convenient interface.

Reduced operational costs – Reduces the number of employees required to manage a streamlined core system.

In a Nutshell

The legacy insurance core systems that have faithfully served the industry for years are now at a crossroads. While they have been the bedrock of insurance operations, their inability to adapt to the demands of the digital age has become increasingly evident. Insurance companies must recognize that clinging to outdated technology hampers efficiency and stifles innovation and competitiveness. The path forward lies in embracing modernization, leveraging cutting-edge technologies, and transitioning to agile, scalable, and customer-centric systems.

The journey toward updating legacy systems may seem daunting, but it is essential for staying relevant in an ever-changing industry. The benefits are clear - improved operational efficiency, enhanced customer experiences, and the agility to respond swiftly to market shifts. As we bid farewell to the old and welcome the new, insurance companies that embark on this transformational journey will position themselves as leaders in an industry poised for remarkable evolution.

Source URL: https://sites.google.com/kmgin.com/home/blog/insurance-core-systems

Comments

Post a Comment