Revolutionizing the Insurance Industry: Robotic Process Automation in Insurance Business Process Outsourcing

In the ever-evolving landscape of the insurance industry, where client expectations are increasing, staying competitive and efficient is paramount. Insurers must not only adapt to market changes but also ensure their core operations are streamlined.

One solution that has gained traction in the recent past is Insurance Business Process Outsourcing. This innovative approach to managing various aspects of the insurance business has proved to be a game-changer for many companies.

The integration of Robotic Process Automation (RPA) into the realm of Insurance Business Process Outsourcing has emerged as a significant catalyst for boosting operational efficiency. This dynamic combination is reshaping the way insurance companies manage their processes, offering unprecedented productivity.

This blog will explore the world of Insurance Business Process Outsourcing, exploring what it is and how the infusion of robotic process automation can help businesses stay competitive.

The Evolution of Insurance Business Process Outsourcing

Before diving deeper, let's learn exactly what insurance business process outsourcing means.

In essence, it involves the delegation of specific insurance-related tasks and processes to third-party service providers, enabling insurers to focus on their core competencies like underwriting, claims management, and customer engagement.

Traditionally, BPOs heavily depended on human resources to handle these processes, leading to several challenges, including human error, slow processing times, and high operational costs. However, with the advent of robotic process automation in insurance business process outsourcing, these challenges are being addressed head-on.

The Rise of Robotic Process Automation in Insurance

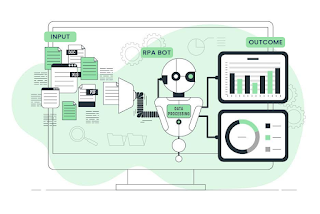

Robotic Process Automation (RPA) is the use of software robots, or "bots," to automate repetitive, mundane, rule-based tasks within business processes. In the context of the insurance sector, RPA is a cutting-edge technology, as it can mimic human actions but with much greater precision and speed.

The Role of Robotic Process Automation in Insurance Business Process Outsourcing

Let's explore how RPA is transforming the landscape of Insurance Business Process Outsourcing.

Claims Processing: Insurance claims are a critical component of the industry, but they can be prone to errors and time-consuming. Robotic process automation can automate the entire claims process, from initial filing to assessment and payment. Bots can extract information from claim forms, verify policy details, and calculate payouts accurately and quickly.

Policy Administration: Managing policies involves a massive amount of data entry and processing. Automation can be used to update policyholder information, generate policy documents, and send renewal reminders. This not only reduces the workload on human employees but also ensures that policyholders receive timely and accurate information.

Customer Service: Virtual assistants and chatbots powered by robotic process automation are revolutionizing customer service in the insurance business through process outsourcing. These bots can handle routine customer inquiries, provide quotes for new policies, guide users through the claims processes, etc. This 24/7 availability improves customer satisfaction and frees up human agents to concentrate on complex issues.

Underwriting: RPA can assist underwriters by automating data collection and risk assessment. Bots can analyze huge amounts of data to help underwriters make more informed decisions, enhancing the accuracy of underwriting and increasing the turnaround time for policy approval.

Regulatory Reporting: Regulatory compliance is a top priority for insurance carriers. RPA can automate the collection and organization of data necessary for reporting, ensuring that carriers remain compliant without the risk of manual errors.

Considerations and Challenges

While the benefits of RPA in Insurance Business Process Outsourcing are evident, it's important to acknowledge the challenges and considerations that come with its implementation:

1. Integration Complexity: Integrating RPA into existing systems can be a complex endeavor. Third-party providers must carefully plan the integration process to minimize disruptions and ensure compatibility.

2. Data Security: With robotic process automation comes the need for robust data security measures. Outsourcing providers must protect sensitive customer data and ensure compliance with data protection regulations.

3. Scalability: RPA solutions should be scalable to accommodate future growth and evolving business needs. Outsourcing companies must plan for scalability to maximize the long-term benefits of automation.

Insurance Business Process Outsourcing – What Lies Ahead?

In a highly competitive industry like insurance, embracing innovation is critical for staying relevant. Insurance business process outsourcing has proven to be a strategic move for many insurance companies.

As we move forward, it's clear that the infusion of robotic process automation in insurance business process outsourcing will prove to be a successful duo for business growth. Automation is no longer a luxury but a necessity for insurance companies. Those who adapt early will likely find themselves better positioned in the ever-evolving world of insurance.

Source URL: https://sites.google.com/kmgin.com/home/blog/insurance-business-process-outsourcing

Comments

Post a Comment